FirstGowealthy provides, rentals, property management & leasing solutions in dubai & uae, leasing & focused rental support services

Tuesday, October 12, 2010

Masdar To Delay Final Completion Until At Least 2020

In an emailed statement released to Dow Jones, the government-backed renewable energy company said the city’s first phase would now be completed in 2015. It also stated that completion on the site would not take place until between 2020 and 2025.

Masdar also added that it may also bring in renewable power from external sources, contrary to its initial plan to use only onsite resources.

Dubai rentals

Tuesday, September 28, 2010

Jumeirah Lakes Towers 60% Complete

This milestone was achieved after Armada Group, a sub-developer, completed the third tower in its mixed-use cluster.

Dubai rentals

Tuesday, September 21, 2010

Service Fee Defaulters Face Losing Their Homes

The Dubai Land Department will repossess and auction off the homes of those who fail to pay maintenance fees as part of the emirate’s new strata law, according to an official notice issued yesterday.

As developers hand over the maintenance of shared buildings and communities to homeowners associations, hundreds of owners who owe thousands of dirhams in service charges risk losing their properties.

Dubai marina

UAE Banks To Make Dh3bn In Dubai World Provisions

Sofia El Boury, a banking analyst at Shuaa Capital's Research Department, said all of the UAE banks have not come clear on their exposure to Dubai World "provisions which could range between Dh2 billion to Dh3bn in the second half considering the latest data."

Wednesday, September 1, 2010

Saudi Mortgage Law To Focus On Affordable Housing Shortage

“Most new developments are targeting the high-income segments of the population which constitute a relatively small share of existing demand,” said Rakesh Kunhiraman, who is the director at the consulting division of Oxford Business Group (OBG).

Thursday, August 26, 2010

Egypt’s Amer Group Invites GCC Investors

Porto Marina is Egypt’s premier destination resort, providing 885 luxurious homes, a 379 room 5-star standard hotel, shops, restaurants, cinema, health spa, gymnasium, marina and private beach.

Dubai apartments

Monday, August 16, 2010

House prices on Palm Jumeirah sink to three year low

In May this year the Arabian Business Think Tank forecast that prices on the Palm Jumeirah will plummet another 20 percent in the next year. It predicted that average prices for an apartment on Nakheel's man-made island will fall to just AED1,022 per square foot by May 2011.

Meanwhile the latest data from real estate consultancy Colliers said that house prices across Dubai fell by four percent in the second quarter, according to the latest data from real estate consultancy Colliers.

Buy A Dubai Property

Friday, August 13, 2010

Thursday, August 12, 2010

Dubai Municipality To Use RERA Index

The Dubai Municipality has also mentioned that it is not ready to withstand any kind of cheating the residents are showcasing by listing rents which are very much below the prevailing market rates for the specific region. According to municipality, it will be forced to use RERA, the Real Estate Regulatory Agency, rent index if any kind of malpractice is witnessed.

Buy a Dubai property

Tuesday, August 10, 2010

Pier Walk Sold Off By Quintain Estates

A whopping £97.1 million ($154.4m; Dh567m) was paid in cash by Deka Immobilien GmbH in exchange for the property, which is almost 6% up from the face value of the property that had been evaluated during March 2010. The investment yield will stand at 5.9%.

Dubai rentals

Monday, August 2, 2010

Jumeirah To Manage Egyptian Luxury Resort

Jumeriah will be managing 250-room multi-purpose hotel of Palm Gamsha. It is a comprehensive community and has 20 artificial islands designed as a sea horse. The resort is situated to the north west of Hurghada airport at a distance of 47 km.

dubai rental

Tuesday, July 27, 2010

REIDIN.com index reveals 6.99% increase in Dubai villa sales price between Q2 2009 and Q2 2010

INDEXFocus is a service dedicated to providing real estate indicies and other benchmark data. Sales Price Index for Dubai (SPID) is launched by REIDIN.com based on the actual transactions in an exclusive partnership with the Real Estate Regulatory Agency (RERA) and the Dubai Land Department (DLD). The service provides the Dubai market with a series of indices and data sets that can help improve transparency across the market and help real estate professionals to benchmark and analyse residential price trends.

Monday, July 26, 2010

Power and water cut from 1,654 Dubai homes in H1

AbdulRahman said about 1,654 houses had had its power and water cut off as a result of violations. He added that surprise visits in coordination with various government departments would continue and fines would be imposed. He said violations included bachelors staying in family areas, and multiple families staying in one house.

Friday, July 23, 2010

The Nation Investor Planning Two Private Equity Deals

He also mentioned that TNI was honing on ‘something substantial’ at present, but declined to disclose the details of the massive transactions.

Dubai rentals

Wednesday, July 21, 2010

Abu Dhabi To Have 73,000 New Homes By 2013

According to the council, out of the 73,000 homes slated to be constructed by 2013, 15,000 will be earmarked for middle income group. The rents will be somewhere around 35% of the income of the household. For those who want to enjoy reduced rent rates, the income should be within the upper ceiling of Dh 252,000.

Dubai Rentals

Tuesday, July 20, 2010

Drake & Scull Wins Dohaland Flagship Cooling Project

According to Mohammad Masoud Al Merri, Director-Projects, Dohaland, “We are delighted to award the design and build contract to Drake and Scull for the district cooling plants for the Musheireb project”. According to the contract, the designing and building of hilled water reticulation network having valves and valve chambers, the mechanical electrical and plumbing services, testing and commissioning of the plants will all be taken care of by Drake & Scull.

dubai rentals

Friday, July 16, 2010

Dubai Properties Group Sees Surge in Demand Following Leasing Campaign

The increased demand is the direct result of DPG’s comprehensive six-week-long campaign to promote its built-to-lease communities across Dubai. DPG has received thousands of calls each week driving hundreds of visits to the community’s site offices daily. The comprehensive campaign was rolled out earlier this month across various marketing channels including the radio, print, digital, online and outdoor platforms.

Dubai rentals

Thursday, July 8, 2010

Dubai Green Buiding's to receive incentives

“The government is working on an incentive plan for green buildings. Dubai has been on the forefront of introducing green concepts… now the code has gone into printing and will be released in two months”, said Essa Al Mai door, Assistant Director-General for Planning and Engineering, Dubai Municipality.

Dubai rentals

Wednesday, July 7, 2010

Dubai Rental Index Being Revamped

The first rent index in Dubai was released in January 2009, complied on the basis of rents during the second half of 2008. Rera says it is not mandatory for landlords to follow the rent index but it is just a guideline or a reference point in case of disputes.

Dubai Rentals

Wednesday, June 30, 2010

Saadiyat Beach Apartment Construction Gets A Nod

Dubai rentals

Tuesday, June 29, 2010

Qatar World Trade Centre Construction Commences

Dubai Rentals

Dubai Real Estate Market Overview

Highlights of the overview:

Dubai Real Estate Market Overview

Q2 2010

Market Highlights – Q2 / 2010

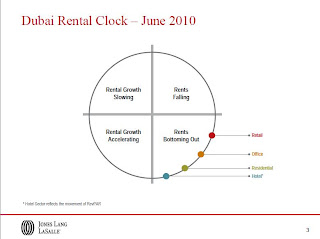

- The Dubai office market continues to fragment with a further decoupling between the overall market(which is experiencing increasing vacancies) and good quality buildings in the CBD (where there remainselective shortages). While average city-wide vacancies have increased further (to around 38%), only12% of the 7.5 million sq ft of completed space in single ownership within the CBD is currently vacant.

- Retail vacancies have increased to between 8% and 10% as competition intensifies and retailers haveclosed poorer performing stores. This is resulting in a flight to quality and increasing problems (brokentooth phenomenon) in poorer quality centres. The more enlightened centre managers are responding tochanging circumstances by seeking to proactively engage and offer more attractive and flexible terms totheir tenants.

- Supply in the residential sector continues to complete, with fewer delays being experienced than in theoffice market. While sales activity has increased and average prices have remained relatively stable,rentals have continued to decline significantly across Q2, particularly in respect of luxury / high end villaand apartment projects.

- The hotel market is the closest to the bottom of the cycle. Increased demand has resulted in a growth ofoccupancies during 2010, but average room rates and RevPAR continue to decline, especially in respectof city hotels.

Dubai Rentals

Dubai Rentals

Thursday, June 24, 2010

Dubai Real Estate Transactions Grow In First Five Months

Dubai rentals

Risk of Property Bubble of Asia Moderate

According to Deborah Schuler who is the Senior Vice-President at Moody's handling the ratings in Asia, the Middle East and Africa, the steps adopted by the government to ease the market have proven to be effective. "At the moment, we think asset bubbles are confined to the property sector and it's still only a moderate risk," she said.

Dubai rentals

Tuesday, June 22, 2010

Low Rents Increases Dubai Villas Demand

"Villa rentals are looking very attractive at the moment. With a further supply of villas to enter Dubai, rentals are expected to decline although at a slow pace. This could trigger a 10 per cent further decline in villa rents. However, villas are strong assets for Dubai and demand for villas is always likely to be higher than apartments. If there is any correction in rental rates for villas it is only because it is a natural market situation," said Mohanad Alwadiya, Managing Director, Harbor Real Estate.

Sunday, June 20, 2010

Emaar Sells Hampton Non-MENA Assets

According to a Emaar spokesperson, “As per the agreement, Countrywide will own and operate Hamptons International offices in the UK, Europe and key Asian markets, while Emaar will own and operate the Hamptons International offices in the Middle East and North Africa regionâ€. But no information on the deal is available. But, Emaar will continue to “share synergies†with Countrywide for the promotion of Emaar Properties across the UK and world.

Friday, June 18, 2010

Luxurious Bahrain Properties Facing Price Fall

Sales of freehold villas and apartments have been almost non-existent in Bahrain over the last two years, which is indicative of the fact that investors are wary in these uncertain economic times and owner occupier demand for luxury property appears to have been satisfied at least in the short term, the report said. Also, the boom times of speculative purchasers enjoying healthy returns on investments by flipping off-plan properties for a profit are a distant phenomenon.

As many of the mixed-use schemes are experiencing construction delays, investors looking to generate rental returns on completed projects are similarly staying away.

Dubai Rentals

Wednesday, June 16, 2010

Dubai is still a key investor’s destination

"But I think the investors should now take advantage of the available opportunities, which are numerous. Dubai still enjoys a good position in this respect and I think there are good investment opportunities in some sectors," Hijazi said.

Dubai Rentals

Tuesday, June 15, 2010

Dubai Property Lease Rates Facing Sharp Decline

According to the Dubai lease guide from Landmark Advisory even though the low-quality buildings and other properties located in less renowned areas are victims to this decline in lease rates, the interesting part is that the quality properties in the most-wanted areas are still facing this decline.

Friday, June 11, 2010

Burj Khalifa Owners Not Keen On Selling Their Units

According to the Portfolio Manager at Networth Real Estate, Rano Rahim, increase in rates is one among the major expectations of the Burj Khalifa owners. According to her, "Further, almost 70 per cent of the people are not ready to sell the property as it has a brand value attached for them. They don't mind putting it up for rent in order to earn returns on their property. Right now, people are only enquiring and asking for our advice on rents and sales values. Since their investment is so huge we are trying to get them the maximum returnsâ€.

Rental Appartment

Thursday, June 10, 2010

Asian Investors Fascinated By Dubai

A Bank of America Merrill Lynch report had mentioned that the prices of property in Dubai have witnessed a dip of 45% when compared to the peak levels it had registered during the third quarter of 2008. But the HC Securities report that was revealed yesterday is a complete contradiction with this. According to the HC Securities report, the cost of Dubai properties are on a growth mode, that is a complete reflection of the increase in interest people have in the real estate sector of the Emirates.

Tuesday, June 8, 2010

Nakheel To Clear Off Its Debts Upto Dh 500,000

But Six Construct and Arabtec, when contacted, mentioned that they were not in the list as Nakheel owes them higher figures. "We do not disclose such information, but we are very pleased with our partners' positive responseâ€, said Nakheel, when asked about the increase in the consenting firms after the UAE Contractors Association meeting, last week.

Dubai Rentals

Monday, June 7, 2010

Jointly Owned Property Law

Dubai Rentals

Thursday, June 3, 2010

Greener building products to reduce Gulf?s 66 million tonnes of annual construction waste

Construction waste can contain materials that lead to soil and water pollution due to harmful byproducts such as solvents, plastics and chemical treatments. The use of non-toxic building materials and furnishings, such as low- and zero- volatile organic compound paints and sealants, is essential to constructing or renovating ‘green buildings’, ensuring that they have minimal environmental impact.

Dubai rentals

Wednesday, June 2, 2010

Abyaar sells 50% of Pier 8 Dubai Marina project

"Although we have been in talks with Kuwaiti banks for getting finance for the project, we decided to sell 50 per cent of our project to a local businessman. He will be part funding the project," the official, who did not wished to be named, said in a telephonic interview.

The 40-storey Pier 8 in Dubai Marina features 234 apartments plus three townhouses and two penthouses. The project has reached the 16th floor, but no new timeline has been set for completion, the official added.

Dubai rentals

Tuesday, June 1, 2010

Wednesday, May 26, 2010

New property law prevents developers from collecting service charges

These guidelines introduced yesterday, of the Strata Law for jointly owned properties will not allow developers to collect service charges until they receive the clearance from Real Estate Regulatory Agency (Rera). As per the guidelines it is also necessary for the developers with under construction projects to submit their drawings to the Land Department's survey section for approval so that rights to communal areas are defined. In case of breach of rules by owners, Rera also has the right to temporarily administer a development.

Dubai Rentals

Gulf property outlook negative on oversupply

"The supply-demand imbalance in commercial property and to some degree in residential units, depending on the city or country, is likely to grow worse as vast supply meets slack demand and is a major driver of our negative outlook," said Martin Kohlhase, author of the report.

Dubai rentals

Wednesday, May 19, 2010

Burj Khalifa, the world’s tallest building described as ‘A Living Wonder’ now has its first residential community. The world’s first Armani Residences in Burj Khalifa recently welcomed its first residents. Close on the heels of the launch of the world’s first Armani Hotel in Burj Khalifa, Emaar Properties, the developer of the mixed-use tower, has handed over homes to buyers of Armani Residences, who now have the world’s most prestigious address.

Armani Residences is developed through a collaboration of Emaar and Giorgio Armani S.p.A. Personally designed by fashion legend Giorgio Armani, the one- and two-bedroom apartments in Armani Residences celebrate luxurious modern living. Located on levels 9 to 16 of the tower, they offer spectacular views of the city and Downtown Dubai.

Omniyat Properties, one of the region’s most innovative developers, has announced the completion of first phase construction work on Dubai’s AAA-rated commercial and retail tower, The Opus. Construction of the iconic AED 1.7 billion developments is well into its second stage with Brookfield Multiplex, the main contractor, recently erecting the four large capacity tower cranes for the project with two levels of basement already complete.

The Opus is strategically located in Dubai Business Bay, the regional business hub which borders the Dubai International Financial Centre (DIFC) and the Dubai International Convention and Exhibition Centre (DICEC) and is easily accessible to Sheikh Zayed Road and to the Business Bay Metro.

Dubai rental

Investor sidesteps Nakheel's 'no flipping' rule by putting 20,000 sqm island on the market for Dh42 million. An investor in The World project may have found a way to go around the "no flipping" diktat by Nakheel as he puts an island on sale, the first time one is being sold in the secondary market.

The 20,000 sqm island is up for sale for Dh42 million, according to Streamline Real Estate Brokers, the agency brokering the deal. When contacted about the’re-sale', a Nakheel spokesperson said: "Flipping is not allowed for islands on The World." A financial expert, on condition of anonymity, said if an offshore company owns the island then it can transfer shares to another person/company, thus transferring ownership. "The question is whether Nakheel will accept the new owners," he added.

Dubai Rentals

Monday, May 10, 2010

Absconding developers in the eye of law

Arra chief insists on resolving the problem between developer and the investor by encouraging mutual talks and this is providing ample time for considerations for the developers. The agency also seek to help t he investors who have invested in projects without opting for carefulness when choosing the developer and his project.

Dubai apartments

Arabtec awarded AED 500m contract to build DAMAC Heights at Dubai Marina

DAMAC Properties has announced that it has awarded the main construction contract for its DAMAC Heights project at Dubai Marina to Arabtec. The AED 500million contract was signed this week and work is expected to commence on site as soon as Zetas complete the enabling works.

DAMAC Heights will be one of the company’s most iconic supertall projects and will occupy a prime position overlooking the Palm Jumeirah. It is within walking distance of another of DAMAC’s flagship projects, Ocean Heights, also being constructed by Arabtec. Work on Ocean Heights is due to be completed later this year.

In announcing the contract award, Chairman of DAMAC Properties Hussain Sajwani said: ‘We are delighted to announce that main construction work will be underway soon at one of our most significant projects in Dubai. We are pleased to work once again with Arabtec who are known for their ability to deliver architecturally challenging buildings and their consistent and solid reputation in the construction industry.

Nakheel Developer won’t hike deposit fee for new sales

Master developer Nakheel continues to consolidate its project portfolio though has denied any raise in non-refundable deposit amount for new sales reservation contracts. This counters reports within the industry that Nakheel had stopped consolidation offers while it has increased the non-refundable deposit by five times of new contracts.

As per sources, Nakheel will determine projects that will remain on hold towards the end of the re-capitalisation process. "Projects have been prioritised following an assessment of construction stages, cost of completion, customer collections, and market supply and demand. We will have determined, which projects are likely to remain on hold towards the end of the recapitalisation process," the spokesperson said.

Majid Al Futtaim Properties to invest $3.5bn in four new shopping malls

Majid Al Futtaim Properties is currently operating 10 malls across the Middle East and North Africa ("MENA") region, which have a combined Gross Leasable Area ("GLA") of 800,000 square metres and which, in 2009, attracted more than 120 million visitors. The four new shopping malls are scheduled for completion by 2014 and will increase Majid Al Futtaim Properties' total GLA to more than 1.3 million square metres.

The announcement was made on the opening day of RECon Middle East & North Africa 2010, the region's major exhibition and conference for retailers and real estate professionals that runs from 2-4 May 2010 at Jumeirah Beach Hotel Convention Centre.

Dubai Apartments

Monday, May 3, 2010

40% of Dubai Rent dispute cases solved in 2009

This year Q1 had 1,119 rent disputes resolved. The first quarter of 2010 witnessed 943 rent dispute cases in Dubai opposed to 2,003 cases in 2009 and 1,635 cases in 2008 during the same period. But there was an increase in the total number of rent dispute cases resolved in 2009 by 10 per cent. As per the committee 6,737 cases were resolved in 2009, while the committee resolved 6,069 cases in the previous year. In the first quarter of this year alone, Dubai resolved 1,119 rent dispute cases. A decline in the new rent cases is mainly due to the fact that more people are now adhering to their rent contracts. People are understanding the law and abiding by their contracts. The main reason for the dispute pertains to landlords or tenants breaching their rental contracts.

Rentals

Friday, April 23, 2010

Dubai off-plan unit sales shows positive trend

Better Homes recorded five per cent of its overall sales in the last month for properties close to completion. Better Homes has sold single off-plan units in various developments in Dubai.

Hesham El Far, CEO, Coldwell Banker, said that around 15 per cent of our overall monthly transactions can be attributed to properties nearing completion. Off-plan sales transactions are mostly a second sale being purchased largely by cash buyers since mortgage is practically nil for these properties. If a property is more than 70 per cent completed and is in a good location, then buyers are going ahead with buying the off-plan property.

Tuesday, April 20, 2010

Abu Dhabi's 2030 vision is Cityscape centrepiece

Sheikh Hamed Bin Zayed Al Nahyan, Chairman of the Abu Dhabi Crown Prince's Court, viewed the 1:2000 model unveiled on the stand of the Abu Dhabi Urban Planning Council during an opening tour of Cityscape. Sheikh Hamed is also Managing Director of the Abu Dhabi Investment Authority, the largest sovereign wealth fund in the world and chairman of General Holding Corporation, the parent company of Emirates Steel.

The model showcases major urban planning initiatives, bringing together economic, cultural, environmental and social aspirations of Abu Dhabi in a single format. The model covers an area from the Corniche on Abu Dhabi's main island to Shahama, Mussafah and Al Falah on the mainland and includes the islands of Saadiyat, Yas, Lulu, Reem and Sowwah.

Property management

Sunday, April 18, 2010

Investor beginning to show confidence in Real Estate

Saudi Arabia and Egypt are the top choice of the investors owing to large local indigenous populations which will be the drivers of real estate demand in the near term. Abu Dhabi is also seen as an interesting market in the long term on the strength of energy rich economies and a definite long term vision. Dubai and Abu Dhabi scored as the highest MENA rankings in terms of city competitiveness.

A survey recorded forty percent of the investors with the notion that Saudi market was already recovering and 30 percent proclaimed the same for Egypt. 75 percent viewed that Dubai’s real estate market would not see recovery for at least 12 months or may be for the next two years.

Investors consistently scored Dubai highly on factors such as infrastructure, connectivity, real estate transparency, quality of life and other attributes.

Tuesday, April 13, 2010

Dubai Marina rules as online buyer’s ideal location

As per the reports Downtown Dubai is also gaining popularity and has jumped five places. Dubai Silicon Oasis owing to its declining price was also finding prominence. Both these areas attracted 4.7 percent and 2.2 percent of searches respectively.

As per the reports Downtown Dubai is also gaining popularity and has jumped five places. Dubai Silicon Oasis owing to its declining price was also finding prominence. Both these areas attracted 4.7 percent and 2.2 percent of searches respectively.Dubai rentals

Thursday, April 8, 2010

Downward trend for house sales in Dubai continues

Markaz anticipated the rental volatility to exist with supply of homes continuing to outstrip demand in the short term. Also the house loan lending would continue to be on the bottom this year due to Dubai banks settlement of the Dubai World debt standstill.

Monday, April 5, 2010

Dubai residential rents continues downward trend

The prices for leasing residential property in Dubai have still not reached a bottom, despite declining around 45 percent in some areas from their 2008 peak. Cluttons’ report into the Dubai property market during the first quarter of this year revealed that residential rents had dropped by an average of 5.5 percent during that period. Property sales were down by an average 2.9 percent. The research note added that the glut of new homes coming online in Q2 would see rent prices dropping still further, and added that the appetite for off-plan development had showed no sign of returning.

Meanwhile, the report also said that commercial rents have slipped by fully 25 percent, and Cluttons warned that only established locations such as DIFC and some areas within TECOM are maintaining over-90 percent occupancy levels. The real estate agency said that it estimated only twenty percent commercial occupancy levels in the newer Jumeirah Lakes Towers district. As free zone landlords are not allowed to lower the cost of rents below AED140 per square foot, the report also indicated that contractual ‘rent-free’ periods – of as much as six months - are becoming more and more commonplace.

Wednesday, March 31, 2010

Burj Khalifa to enhance 2010 revenues

Dubai's Emaar Properties announced that revenues stemming from the sale of units at Burj Khalifa, the recently-opened, world's tallest tower, will boost the company's 2010 revenues. Emaar, 31.2 per cent owned by the Dubai government, is the Arab world's largest listed developer. It posted third-quarter revenue of Dh1.95 billion. As Emaar recognises revenue and profits on delivery of the project, the revenue relating to the units sold in Burj Khalifa will be recognised in 2010 on delivery, spokesman said.

Dubai's Emaar Properties announced that revenues stemming from the sale of units at Burj Khalifa, the recently-opened, world's tallest tower, will boost the company's 2010 revenues. Emaar, 31.2 per cent owned by the Dubai government, is the Arab world's largest listed developer. It posted third-quarter revenue of Dh1.95 billion. As Emaar recognises revenue and profits on delivery of the project, the revenue relating to the units sold in Burj Khalifa will be recognised in 2010 on delivery, spokesman said. Emaar has a joint venture with Italian luxury company Georgio Armani to develop hotels around the world, including one at the Burj Khalifa.

Monday, March 29, 2010

Real Estate Market Looking Stable

Dubai real estate market is reaching stability with positive signs in rental of 1 per cent in January and 6 per cent in February. This is the initial positive upward trend that can be noticed after nine months of decline. Rental prices in Dubai stabilised last November and recorded strong gains until February with a 6 per cent month on month increase. Prices were up by 6 per cent in February after a 13 per cent drop following the Dubai standstill announcement last November.

Dubai real estate market is reaching stability with positive signs in rental of 1 per cent in January and 6 per cent in February. This is the initial positive upward trend that can be noticed after nine months of decline. Rental prices in Dubai stabilised last November and recorded strong gains until February with a 6 per cent month on month increase. Prices were up by 6 per cent in February after a 13 per cent drop following the Dubai standstill announcement last November. The survey suggests that areas which witnessed the highest number of handovers recently actually saw declines in February; namely Downtown Burj area with a 5 per cent decrease and Dubai Marina with 10 per cent. According to the report, rental rates in Dubai were helped by the spillover from neighbouring emirates (particularly Abu Dhabi) which anecdotal evidence suggests gained momentum last year. The report said mortgages have continued to tighten ahead of the Dubai World debt restructuring proposal. Mortgage volumes fell to 11 per cent in February from 25 per cent in September. Cash buyers were seen to be picking up smaller, more affordable units in areas such as International City (up 9 per cent), Greens (up 11 per cent) and Jebel Ali (up 10 per cent). The report said that the restructuring of Nakheel which controls 50 per cent of expected supply is predicted to lead to further project delays and cancellations supporting sector dynamics. However, expected recovery in the global economy and stronger growth in the UAE this year is likely to support demand.

Real Estate Market Looking Stable

Friday, March 26, 2010

Comparatively Palm property prices still high

Apparently Palm Jumeirah has cut its price by 40 percent from their August 2008 peak. But according to Real Estate expert, units on the Nakheel development are still overpriced. Compared to London, Paris and New York, prices on Palm are still high. In comparison to last year, prices for incomplete units were down by 50 percent and that rents were down by a quarter - favourable to other freehold areas in Dubai.

Apparently Palm Jumeirah has cut its price by 40 percent from their August 2008 peak. But according to Real Estate expert, units on the Nakheel development are still overpriced. Compared to London, Paris and New York, prices on Palm are still high. In comparison to last year, prices for incomplete units were down by 50 percent and that rents were down by a quarter - favourable to other freehold areas in Dubai. However based on the number of units due to complete over the next two years it is unlikely that prices will increase. Despite the difficulties faced over the last 18 months the UAE remains a commercial nerve centre of the Middle East. After a period of consolidation of between three and five years prices are expected to rise again. Established areas such as the Springs, Meadows, Jumeirah Islands and the Palm had performed well historically and would continue to see a high turnover of transactions. Dubai World announcement is expected to bring a positive period for the UAE.

Thursday, March 25, 2010

Projects delayed owing to poor planning

The blame on lack of funds holding progress of projects has been proved wrong in a survey which claims that it’s the lack of co-ordination between agencies in the GCC which is responsible for it. In spite of cost and schedule overruns it is completion of a project that makes it successful. A team of professors at the UAE University asked a good sample of sponsors or clients, government departments, contractors, consulting and management firms whether their projects were successful. Despite the many delays and doubling or trebling of total costs, 100 per cent of them replied, "YES".

The blame on lack of funds holding progress of projects has been proved wrong in a survey which claims that it’s the lack of co-ordination between agencies in the GCC which is responsible for it. In spite of cost and schedule overruns it is completion of a project that makes it successful. A team of professors at the UAE University asked a good sample of sponsors or clients, government departments, contractors, consulting and management firms whether their projects were successful. Despite the many delays and doubling or trebling of total costs, 100 per cent of them replied, "YES".Dubai real estate

Wednesday, March 24, 2010

Dubai home prices slides further

Dubai real estate performed the worst in the current year gliding further by 45 percent. The report is from The Wealth Report 2010 produced by Citi Private Bank and property consultancy Knight Frank. It also showed that Dubai was the biggest faller in the list of the world's 40 most influential cities. The emirate is facing the blow from global economic crisis and plummeted three places to 31 in a list based on their economies, political power, knowledge and quality of life.

Dubai real estate performed the worst in the current year gliding further by 45 percent. The report is from The Wealth Report 2010 produced by Citi Private Bank and property consultancy Knight Frank. It also showed that Dubai was the biggest faller in the list of the world's 40 most influential cities. The emirate is facing the blow from global economic crisis and plummeted three places to 31 in a list based on their economies, political power, knowledge and quality of life. New York was the top scorer taking over London's top spot this year, as the UK capital also struggled with the financial downturn. High-end home prices faced turmoil all over but Dubai prices were by far the worst hit and Dublin seeing the second highest declines (25 percent). Luxury home prices rose more than 40 percent in the Chinese cities of Shanghai, Beijing and Hong Kong.

Tuesday, March 23, 2010

Dubai mortgage market soars by 75%

Dubai mortgage market is seeing an upward surge by 75 percent for this fiscal year. Dubai Land Department has made the comparison with same period last year. Official Dubai Land Department (DLD) has given the value based on registration on the system between January 1 and March 21 AED9.99bn ($2.72bn). Comparison shows increase in value by 75 percent to last year when AED5.68bn ($1.54bn) worth of new mortgages was processed.

Dubai mortgage market is seeing an upward surge by 75 percent for this fiscal year. Dubai Land Department has made the comparison with same period last year. Official Dubai Land Department (DLD) has given the value based on registration on the system between January 1 and March 21 AED9.99bn ($2.72bn). Comparison shows increase in value by 75 percent to last year when AED5.68bn ($1.54bn) worth of new mortgages was processed.Monday, March 22, 2010

Union Properties willing to sell assets

Dubai's Union Properties is willing to sell all any of its projects if it receives a fair price. Union Properties, the third-largest developer in the Gulf Arab emirate has been hit by the global downturn, which has sent prices in Dubai's once-booming property sector tumbling some 50 percent from their peaks in 2008. The developer has received offers for its Ritz Carlton hotel in Dubai which the debt-laden firm is hoping to sell for about AED1.5bn ($408.4m).

Dubai's Union Properties is willing to sell all any of its projects if it receives a fair price. Union Properties, the third-largest developer in the Gulf Arab emirate has been hit by the global downturn, which has sent prices in Dubai's once-booming property sector tumbling some 50 percent from their peaks in 2008. The developer has received offers for its Ritz Carlton hotel in Dubai which the debt-laden firm is hoping to sell for about AED1.5bn ($408.4m). The company's complete projects have achieved their investment targets and they are being offered to investors for sale. Buyers are mainly investment companies and individuals who are looking to buy complete and rented properties with an income of 7-8 percent. The funds raised from asset sales will be used to repay financial commitments and finance ongoing property projects. The firm posted a third consecutive quarterly loss on provisions for contracting and property revaluation. It has 6.5 billion dirhams of outstanding debt, of which 2.8 billion had been rescheduled for payment to 2011 from 2009, with the remainder maturing in the long-term.

Sunday, March 21, 2010

EPG repurchasing units in Palm Jumeirah

The Kempinski Palm Jumeirah Residences range in size from 165 square metres to 1,300 sq m, all including terraces or balconies. The developments consists of a mix of two-, three- and four-bedroom suites and residences, a selection of penthouses and townhouse-style royal villas with their own private pools and gardens. EPG has a strategic partnership with Kempinski Hotels. The developer has commenced work on Emerald Palace Kempinski in Palm Jumeirah.

Thursday, March 18, 2010

Property market on the way to recovery

Dubai Pearl is building four 73-story towers connected by a single roof less than a mile from the emirate’s palm-tree shaped man-made islands shaped like palm-trees. The project, which has the same name as the company, will have 20 million square foot (1.9 million square meters) of hotel and residential space. MGM Grand, SkyLofts, Bellagio, and Baccarat are among the six hotels that will have 1,400 rooms. The main structure will be surrounded by an artificial beach and low-rise buildings containing malls and theaters. The project is scheduled for completion 2013.

More Information

Wednesday, March 17, 2010

Low rents lures people to Dubai

Dubai has become more competitive and attractive for those working in the UAE due to the reduction in residential rentals. Residents moving to Dubai from locations such as Abu Dhabi and Sharjah are most likely reason for a 7.6 percent rise in the emirate’s population last year. Jones Lang LaSalle (JLL), an expert from real estate consultancy Jones Lang LaSalle has claimed, “The major driver for this ‘Dubai Effect’ has been the reduction in residential rentals, which has resulted in Dubai becoming more competitive and therefore attractive for those working in the UAE. “The other component of the ‘Dubai Effect’ is an increase in the number of households, as falling residential rentals are reducing the need for several households to share the same unit. The total demand for residential units is therefore increasing more rapidly than the overall population of Dubai.”

While the increase in demand was certainly good news for landlords, it was important to recognise that it is very dependent upon the level of rentals, with increased demand being driven largely by falling rental prices. Jones Lang LaSalle has said it expects rentals to stabilise in some projects and locations in 2010, but that the overall level of residential rentals will decline further in 2010.