The first phase of Saadiyat Beach Apartments will soon kick off as The Tourism Development and Investment Company, which is the prime constructor of tourism, cultural, and residential destinations in Abu Dhabi, has assigned the development work to Abu Dhabi-based Dhabi Contracting Establishment. About 495 apartments will be constructed in the first phase.

Located in the centre of a Saadiyat Beach community, the plans have been deciphered with Arabian and Mediterranean elements. The first phase is expected to be ready by 2011 Q4.

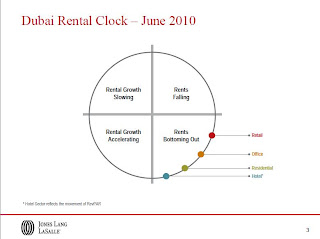

Dubai rentals

Dubai rentals